Living on borrowed time

As relentless as this bullish market has been, I think it is somewhat naive to believe that it will continue much longer. Things this quarter have been great for the equity markets. We've witnessed a first quarter gain that has been better than most yearly gains. If you haven't booked some profits and/or moved at least part of your portfolio into something "crash resistant" then you are asking for trouble, my friend. While it is true that I've been a hater of this rally (and I have been wrong) since 1 Jan, I still think something nasty is lurking in the next month or two and it is going to hurt a lot of investors who are just starting to throw money at the stock market again.

Daily scores (13 Feb to 15 Mar):

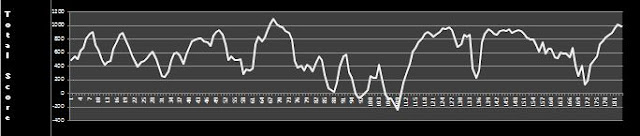

Chart of the "Score Total" (June 2012 to Today):

... looks pretty high, don't it?

Regular readers know that I'm somewhat fascinated by Elliot Wave theory. For those who are not familiar, here is a picture from Wikipedia that sums it all up:

The idea is that markets move in waves, and each big wave can be broken into smaller waves. Now, here's the DJIA with my caveman interpretation of Elliot Waves:

So, I suspect there will be an end to the 5th wave in the next week or two. After that there should be a fairly significant correction. At a minimum it would be a an A-B-C correction targeting the 13,600 to 13,300 range. Assuming a peak at 14,600 those numbers would correlate to about a 50% to 61.8% Fibonacci retracement of this wave.

GOOD LUCK NEXT WEEK!

No comments:

Post a Comment