RUM Wave Market Alert: SECURE PROFITS

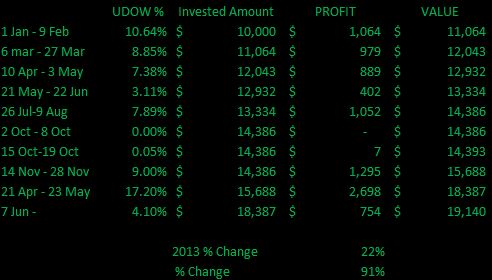

RUM Wave indicators suggest that this is a good time to secure profits following the 16 Dec buy signal. Aggressive market participants could continue to ride this wave, however at 12% UDOW gain in 15 days it makes sense to take some of the profits off the table. Below is the sample portfolio ledger:

Sunday, December 29, 2013

Tuesday, December 17, 2013

Buy Signal, 16 Dec

MARKET ALERT - Buy Signal generated on 16 Dec

RUM Wave market indicators generated a US Equity Buy signal on 16 Dec. Strength of this signal should be considered "moderate." This should take us through the end of 2013 and probably into January of 2014. Any trades should, however, be backed up by trailing or manually adjusted stops.

Thursday, October 31, 2013

Sell signal

Market alert: SELL signal generated

I'm posting this from my phone today, so I can't update the needles yet, but a sell signal was generated yesterday.

I'm posting this from my phone today, so I can't update the needles yet, but a sell signal was generated yesterday.

Sunday, October 20, 2013

Martket Alert: RUM Wave SECURE PROFITS signal

Market Alert: RUM Wave SECURE PROFITS signal

RUM Wave Analytics has moved to a SECURE PROFITS signal with a 5 day forecast of NEUTRAL.

While a change in trend to the downside has not been confirmed, our indicators are showing a short term top could be approaching in the near future. If one was to follow our trading strategy and purchased a triple leveraged ETF (such as UDOW) on the day following our last BUY signal they would be enjoying a little more than a 5% gain in 10 days. Investors that are content with that return should consider securing those profits at this time. More aggressive investors could remain in the market a while longer until a SELL signal is generated but will run additional risk of a sudden market downturn.

RUM Wave Analytics has moved to a SECURE PROFITS signal with a 5 day forecast of NEUTRAL.

While a change in trend to the downside has not been confirmed, our indicators are showing a short term top could be approaching in the near future. If one was to follow our trading strategy and purchased a triple leveraged ETF (such as UDOW) on the day following our last BUY signal they would be enjoying a little more than a 5% gain in 10 days. Investors that are content with that return should consider securing those profits at this time. More aggressive investors could remain in the market a while longer until a SELL signal is generated but will run additional risk of a sudden market downturn.

Friday, October 11, 2013

Market Alert: RUM Wave BUY Signal

Market Alert: RUM Wave Buy Signal

A BUY signal was generated Thursday, however I'm a little cautious about it. It is not the type of signal that typically signals a strong rally. Any buying of new positions should be closely monitored. Trailing stops are definitely warranted for now.

A BUY signal was generated Thursday, however I'm a little cautious about it. It is not the type of signal that typically signals a strong rally. Any buying of new positions should be closely monitored. Trailing stops are definitely warranted for now.

Tuesday, October 8, 2013

Market Alert: Status change to HOLD

Market Alert: Status change to HOLD

A majority of the selling looks to be complete in this decline. A change in trend direction to the upside is on the horizon, but is not here yet. I think we are very likely to see a bounce based on the new Fed chairperson announcement, but the debt ceiling debate still looms.

A majority of the selling looks to be complete in this decline. A change in trend direction to the upside is on the horizon, but is not here yet. I think we are very likely to see a bounce based on the new Fed chairperson announcement, but the debt ceiling debate still looms.

Saturday, September 28, 2013

Market Alert: SELL signal

Market Alert: SELL signal generated

Friday's market action produced a RUM Wave sell signal. While a temporary rebound may occur, continued medium-term down trend is likely. The previously issued "Secure Profits" signal occurred near the short/medium term market peak and yielded a return of 8.3% during the period 20 August to 22 September utilizing a 3x DJIA ETF (symbol UDOW.) Cumulative 2013 RUM Wave performance has been 100% profitable on buy / sell signals while yielding 45% return on the notional portfolio below.

Sunday, September 22, 2013

Market ALERT: Status change to SECURE PROFITS

Status Change to SECURE PROFITS.

My indicators are showing signs of peaking. Although a "Sell" signal has not been generated, I think it is a good time to employ profit securing strategies on short term equity market investments, particularly the leveraged ETFs that I like to trade. I like Trailing Stops (or just Stops if your trading platform does not allow trailing stops) if you cannot actively monitor your positions.

My indicators are showing signs of peaking. Although a "Sell" signal has not been generated, I think it is a good time to employ profit securing strategies on short term equity market investments, particularly the leveraged ETFs that I like to trade. I like Trailing Stops (or just Stops if your trading platform does not allow trailing stops) if you cannot actively monitor your positions.

Monday, September 16, 2013

Prepare to secure profits

16 Sep ALERT: Prepare to secure profits. Market conditions have reached an overbought status according to RUM Wave indicators.

Saturday, September 14, 2013

Thursday, September 12, 2013

September Wave

Update to the sample profile ledger below as of market close on 12 Sep. I put out the buy recommendation (using the needles above) on 20 Aug.

Monday, July 29, 2013

Profits Secured

29 July Update

Profits secured on all UDOW positions. 13.3% return on investment 26 Jun - 29 Jun.

Sample ledger:

Profits secured on all UDOW positions. 13.3% return on investment 26 Jun - 29 Jun.

Sample ledger:

Saturday, July 20, 2013

Saturday, July 6, 2013

Saturday, June 22, 2013

Got Stopped out with Fed

"Fed Day"

Fed day was brutal for the markets. I set up my stops to take me out with a 1% gain, and that is exactly what happened. Oh well, we're setting up for another buying opportunity in the not so far off future. Here is my "sample trade" ledger incorporating the evaporation of my most recent profitable trade.

Fed day was brutal for the markets. I set up my stops to take me out with a 1% gain, and that is exactly what happened. Oh well, we're setting up for another buying opportunity in the not so far off future. Here is my "sample trade" ledger incorporating the evaporation of my most recent profitable trade.

Friday, June 7, 2013

Friday, May 24, 2013

Changes

New Look!

I decided to change things a bit. Hopefully it will be more intuitive for readers. Here is a ledger of example trades using the RUM Wave for CY 2012 & 2013. Enjoy!

I decided to change things a bit. Hopefully it will be more intuitive for readers. Here is a ledger of example trades using the RUM Wave for CY 2012 & 2013. Enjoy!

Thursday, May 23, 2013

Saturday, May 18, 2013

RumWave catches the Dow

Still in "Hold" mode since last green light

Without a doubt, this has been an amazing rally. Since the last green light the RumWave method has returned 18%, surpassing the Dow. Although we missed the first quarter's move, I feel much better now that we have caught up to and passed my stated benchmark, the DJIA. Now we just have to wait for a sell signal.

My daily scoring system shows the DJIA in overbought territory, but so does almost every other oscillator out there.

Below are the historical scores since I developed this system. The farthest right point is the most recent data point. As you can see, things are pretty hot.

Below are graphs of the components that create the overall daily scores. All of them are very high compared to historic data.

Next is a 4 hour chart of the DJIA (each candle represents 4 hours of time.) Again, no signs of breakdown.

Without a doubt, this has been an amazing rally. Since the last green light the RumWave method has returned 18%, surpassing the Dow. Although we missed the first quarter's move, I feel much better now that we have caught up to and passed my stated benchmark, the DJIA. Now we just have to wait for a sell signal.

My daily scoring system shows the DJIA in overbought territory, but so does almost every other oscillator out there.

Below are the historical scores since I developed this system. The farthest right point is the most recent data point. As you can see, things are pretty hot.

Below are graphs of the components that create the overall daily scores. All of them are very high compared to historic data.

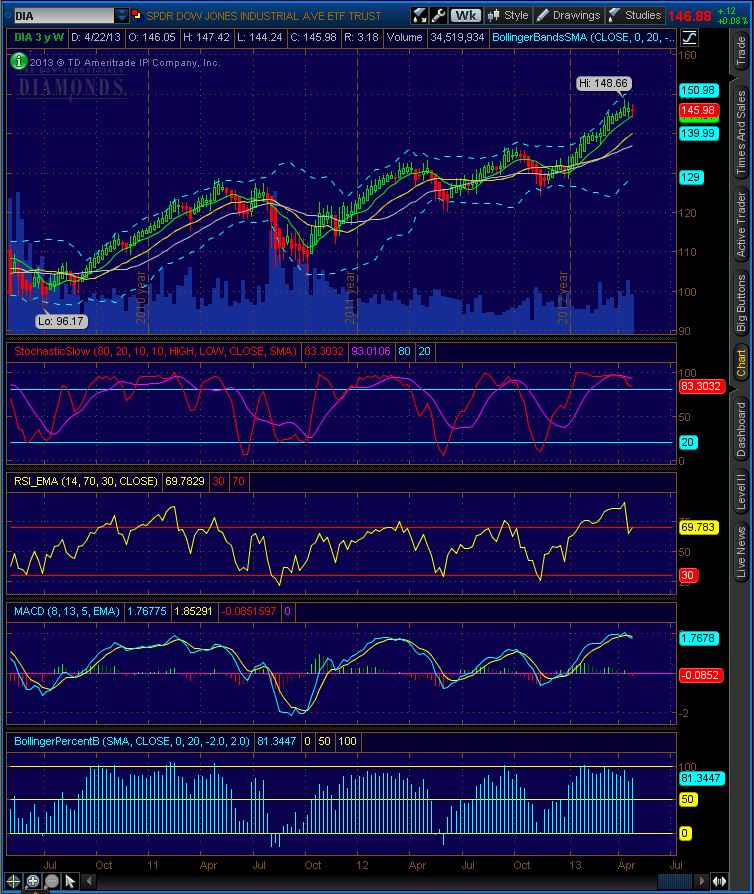

Below is the DJIA (Daily) chart. Each candle represents one day of time. There are no signs of breakdown yet.

Next is a 4 hour chart of the DJIA (each candle represents 4 hours of time.) Again, no signs of breakdown.

Last is a chart of the S&P 500 (4 hour chart, including extended hour trading) This chart looks quite bullish to me.

Ultimately, I don't have a sign from the RumWave or from basic technical looks of the charts to sell at this point. So, I'll continue to hold. I don't particularly like the idea of putting new money to work here. Doing so would be a lot of "chasing" and could lend itself to losses.

If / When I get a RumWave sell signal, I will post it on this blog.

GOOD LUCK NEXT WEEK!

Wednesday, May 8, 2013

Maxed out

Scores are Maxed Out

There are few times that I can predict moves with certainty. This is probably one of them. The market is way too big for it's britches here. My scores are near all time peak levels. I think a consolidation day is needed at the very least.

There are few times that I can predict moves with certainty. This is probably one of them. The market is way too big for it's britches here. My scores are near all time peak levels. I think a consolidation day is needed at the very least.

Score Total June '12 to Today:

Saturday, May 4, 2013

Strong week

Sell in May gets squeezed

The Jobs report yesterday took a lot of market skeptics by surprise. I think a lot of the action yesterday was the result of a big short squeeze. My scoring system indicates that the market has reached the pivotal range. The weekly charts are leading me to believe that we may see a couple more up weeks before a larger downtrend resumes. Good news out of Europe and the US will probably fuel more market gains.

GOOD LUCK NEXT WEEK!

The Jobs report yesterday took a lot of market skeptics by surprise. I think a lot of the action yesterday was the result of a big short squeeze. My scoring system indicates that the market has reached the pivotal range. The weekly charts are leading me to believe that we may see a couple more up weeks before a larger downtrend resumes. Good news out of Europe and the US will probably fuel more market gains.

GOOD LUCK NEXT WEEK!

Sunday, April 28, 2013

CHANGE OF PACE

Moving to Weekly Updates only

Well, ladies and gents, I've given a lot of thought to this blog the last few days and the time-cost of it. After about 10 months of daily updates (give or take a day or two here and there,) I've decided that I want to reallocate my time each night to other things. Accordingly I will only update this blog on the weekends when I have more time available. Thanks to the regular readers out there across the planet, and I hope you continue to find this information useful in your market analysis. I'll post updates if things are news worthy. I'll also update my thoughts on Twitter, so feel free to follow me @RumWave.

Here's were we stand:

- Weekly charts are giving way to some weakness. Witness the red candle at the top of the DIA weekly chart:

Here are the daily scores. They suggest that on a short term level, there is some room to move higher still:

Overall, I'm very cautious of the market's intentions. I think we may end up seeing some volitility as the market find its top here. This should benefit traders that use shorter scale charts (4hrs and less).

My position is that of "Hold" and/or secure profits.

GOOD LUCK NEXT WEEK, I'll see you next weekend!

Wednesday, April 24, 2013

Booked profits

Booked UDOW profits today

Although a "red light" signal isn't anywhere close, my gut told me to take my winnings to the cash register today. The market showed a lot of difficulty climbing today, and it was at the RumWave resistance level I described yesterday.

Scores:

GOOD LUCK TOMORROW!

Although a "red light" signal isn't anywhere close, my gut told me to take my winnings to the cash register today. The market showed a lot of difficulty climbing today, and it was at the RumWave resistance level I described yesterday.

Scores:

GOOD LUCK TOMORROW!

Tuesday, April 23, 2013

Good day for RumWave trades

Today was a good day

RumWave inspired trades profited today. I'm seeing a bit of resistance on the RumWave chart, so we'll see if the indexes can power through.

GOOD LUCK TOMORROW!

RumWave inspired trades profited today. I'm seeing a bit of resistance on the RumWave chart, so we'll see if the indexes can power through.

GOOD LUCK TOMORROW!

Monday, April 22, 2013

No changes

No changes

I'm still cautiously optimistic here. I'd feel a lot better if the weekly charts weren't so high, but for now I'm letting my positions ride. It feels like the move up will be a difficult one.

Scores:

I'm still cautiously optimistic here. I'd feel a lot better if the weekly charts weren't so high, but for now I'm letting my positions ride. It feels like the move up will be a difficult one.

Scores:

Score Total since June '12:

GOOD LUCK TOMORROW!

Sunday, April 21, 2013

Cautious Green Light

Cautiously turning on Green Light

Short term signs point up. My RumWave chart is showing a bottoming pattern. Extreme caution is advised here because the weekly charts favor medium term downtrends. Remember, my expected trading period is 10-15 days. This one may be shorter than that.

Scores:

"Score Total" since June ' 12:

DJIA 4 hr chart: MACD looks to be turning a corner.

DJIA Daily Chart: Bullish Hammer candle on Friday.

Overall, I expect the general market trend to be up for the short term.

GOOD LUCK NEXT WEEK!

Short term signs point up. My RumWave chart is showing a bottoming pattern. Extreme caution is advised here because the weekly charts favor medium term downtrends. Remember, my expected trading period is 10-15 days. This one may be shorter than that.

Scores:

"Score Total" since June ' 12:

DJIA 4 hr chart: MACD looks to be turning a corner.

DJIA Daily Chart: Bullish Hammer candle on Friday.

Overall, I expect the general market trend to be up for the short term.

GOOD LUCK NEXT WEEK!

Thursday, April 18, 2013

Wrong about the bounce

I was wrong about the bounce

I really thought we would gap higher this morning based on the bullish divergences I was seeing on yesterday's charts. However, the market proved me incorrect. The bullish divergences are still very easily seen on 1 hr charts of the DJIA, S&P, and RUT. The QQQ does not show a bullish divergence.

The RumWave system is very close to the "green light." I just need a little more downside movement and the trigger will probably be met. Despite not quite having the complete green light signal, I did begin scaling into bullish UDOW positions.

We haven't had a green light yet this year. When it does happen, remember that the time horizon could be fairly short, especially given the current levels of the indexes.

Daily Scores:

GOOD LUCK TOMORROW!

I really thought we would gap higher this morning based on the bullish divergences I was seeing on yesterday's charts. However, the market proved me incorrect. The bullish divergences are still very easily seen on 1 hr charts of the DJIA, S&P, and RUT. The QQQ does not show a bullish divergence.

The RumWave system is very close to the "green light." I just need a little more downside movement and the trigger will probably be met. Despite not quite having the complete green light signal, I did begin scaling into bullish UDOW positions.

We haven't had a green light yet this year. When it does happen, remember that the time horizon could be fairly short, especially given the current levels of the indexes.

Daily Scores:

GOOD LUCK TOMORROW!

Wednesday, April 17, 2013

Big 'ol Bounce tomorrow

Good opportunity to catch a pop

I wish I could have been looking at my charts going into the close today. There is lots of evidence that the market will gap higher at the open tomorrow. We'll see if it holds.

Scores:

The big note is that the RumWave score is really low. I don't expect it to stay there.

GOOD LUCK TOMORROW!

I wish I could have been looking at my charts going into the close today. There is lots of evidence that the market will gap higher at the open tomorrow. We'll see if it holds.

Scores:

The big note is that the RumWave score is really low. I don't expect it to stay there.

GOOD LUCK TOMORROW!

Tuesday, April 16, 2013

Pivotal day tomorrow

A Fork In The Road

Which path will the markets take? I think another leg to the downside would make sense as a "C" wave. It will be interesting to see. My charts don't really favor one way or another.

Scores:

"Score Total" June '12 to today:

Good luck tomorrow!

Subscribe to:

Posts (Atom)