Bottom is close, scale in if desired NEW POLL------>

(Updated Sunday, 2 pm CST for an incorrect chart)

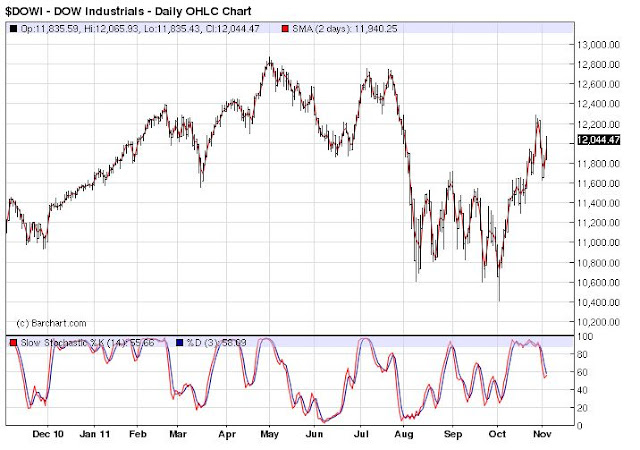

The stoplights are a little confusing but in this post I'll show you why I think there are only a couple more trading days before a move higher gets underway. The RumWave chart and my daily scoring system both show the market pretty close to a bottom. There are no crystal balls in this business, but everything would be nicely lined up for a move higher if we had one or two more down days (about 150 - 200 Dow points). That said, the market has bounced off current levels in the past, so it is not beyond the scope of reason that it could take off at any time. For that reason, I recommend scaling into your positions here if you are investing a significant amount of cash, especially if we see declines. If you are playing with a small lot (I'm talking 1-2k) you'll probably be happier just to wait another day or two. Here are the end of day numbers for Friday:

Here are the daily scores. Notice the dark greens.. that's a good thing for bulls. The daily score is still a bit high being that burnt orange color (go Texas!).

Above is a side by side comparison of the Dow Jones Industrial Average (left) and the Euro-US Dollar currency pair (right). If you ever doubted that our market moves in tandem with the Euro.. here's your proof. Both are finding a little support along their 20 day moving averages (blue line) and for the Euro, it also coincides with a 50% Fibonacci retracement. The takeaway from this is that a weak US dollar = stronger apparent stock market. I say apparent because your actual buying power is reduced in the process but it at least makes you fell like you have more money in your account, and that is the stated intent of the Fed's latest stimulus plan. Good news for market bulls.

Above is a depiction of a Head and Shoulders chart pattern. For those readers who are unfamiliar, it is a very popular signal for those that like to read charts. Now, lets take a look at the S&P and Russell 2000 charts on a 30 minute scale (each candle represents 30 minutes of time).

Did you see the Head and Shoulders patterns that developed the last three days? From this, we would expect a move lower that targets the 1420s region on the S&P. That would be about 20 S&P points and based on my general multiple of 10 correlation between the Dow and S&P, 200 Dow points. This is the move we need to get a strong bullish impulse started.

Questions, comments about the blog? Email me: rumwavetrading@gmail.com

GOOD LUCK NEXT WEEK!