Today the Leading Directional Indicator (LDI) turned bearish again. This is likely signaling a big swooping decline in the near future. The Russell 200 (below) looks about ready to roll over as well.

Monday, June 30, 2014

Friday, June 27, 2014

Thursday, June 26, 2014

Market Dashboard - Declining indicators

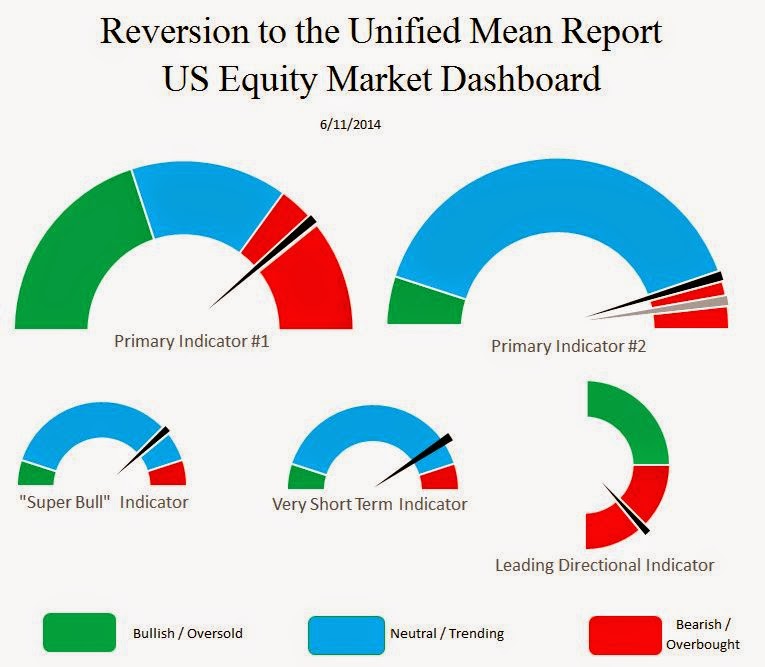

Primary Indicator #2 is moving rapidly lower as a result of today's action. Primary Indicator #1 needs to get into the green zone for us to have a good entry point.

Wednesday, June 25, 2014

Market Dashboard - Small Cap Buy Opportunity

There are currently no strong entry point signals. However, I do believe small cap indexes could see a small rally due to the chart below.

Tuesday, June 24, 2014

Market Dashboard - Decline

Notable decline in the broader market today. Interestingly the Very Short Term Indicator is in the green and the LDI is bullish. However, PI #1 and PI #2 are not signaling an entry point. That said, it looks like a bounce is probable, but this is not a good medium term entry point.

Monday, June 23, 2014

Market Dashboard - Waiting

The market indicators are starting to move down from their highest levels (PI#1 and PI#2) and the LDI is still bearish.

Saturday, June 21, 2014

Market Dashboard - waiting for reversion to start

The LDI is still pointing to the downside, indicating a bearish trend forming. The Russell 2000 bearish divergence is still intact (below.)

Thursday, June 19, 2014

Market Dashboard - Bearish Signs

Overall, I'm a little concerned about the next few days / weeks for US equities. The LDI is currently displayed in a binary (bullish or bearish) setup. However, the behind the scenes math does have a degree of severity. Today the raw numbers behind the LDI took a nasty turn lower. Coupled with a bearish divergence on the Russell 2000, we may be seeing a bit of a correction before long.

Wednesday, June 18, 2014

Market Dashboard - News Rally

Today's the primary indicator #1 moved back up to the overbought range as a result of the Fed news inspired rally. I'm not sure how long this will last because the LDI is still bearish.

Tuesday, June 17, 2014

Market Dashboard - LDI swings bearish

Today there were mild gains in the major US indexes and a pretty strong showing in the Russell 2000 small cap index (below.) The LDI (leading directional indicator) swung back to the bearish side today leading me to think there is more correction just around the corner.

Monday, June 16, 2014

Market Dashboard - Small Caps Up

Today's market was relatively unchanged, however we did see the Primary Indicator #2 continue to decline. Notably the Russell 2000 was positive on the day to the tune of .5%. This is likely what we are seeing drive the LDI (Leading Directional Indicator) positive. The Russell chart looks like it may have some legs to run on, so we may stave off a correction for a little longer.

Saturday, June 14, 2014

Market Dashboard - Retreating with a bounce

Primary indicator #1 has moved into the trending zone and primary indicator #2 is continuing to retreat in the trending zone. Of note, the leading directional indicator did swing bullish. This may indicate a quick market bounce, but it is too early to signal a good entry point. If it had happened with Primary #1 and Primary #2 in the green, then I would put my money to work. For now, it looks like a good time to keep money in a safe place with very little US equity market exposure.

Above is a screen capture from my thinkorswim platform. I've been looking at a study that comes with the software called volume profile. It is a measure of volume against price levels. You can see how much it resembles a bell curve (I added the blue bell curve line.) The concept is that the price should gravitate back toward the middle of the curve if it is out on the tails (edges.) Currently the SPY is out on a tail, and has moved down from the extreme edge.

When I zoom in a little it looks like the SPY is right in the middle of two small nodes. My observation has been that stocks / indexes don't stay there for long because there are not as many sellers / buyers. The question is, which way will it go? Based on my other data, I think we may see it bounce up a little, but then regain the momentum back to the larger volume areas.. which is bearish.

Above is a screen capture from my thinkorswim platform. I've been looking at a study that comes with the software called volume profile. It is a measure of volume against price levels. You can see how much it resembles a bell curve (I added the blue bell curve line.) The concept is that the price should gravitate back toward the middle of the curve if it is out on the tails (edges.) Currently the SPY is out on a tail, and has moved down from the extreme edge.

When I zoom in a little it looks like the SPY is right in the middle of two small nodes. My observation has been that stocks / indexes don't stay there for long because there are not as many sellers / buyers. The question is, which way will it go? Based on my other data, I think we may see it bounce up a little, but then regain the momentum back to the larger volume areas.. which is bearish.

Thursday, June 12, 2014

Market Dashboard - Retreat Continues

Primary Indicator #1 is almost back in the blue "trending" range and Primary Indicator #2 is solidly back in the "trending" range. Given that the trend has been bearish over recent sessions, this suggests that we are setting up for a downward trend.

Wednesday, June 11, 2014

Market Dashboard - Retreating Market

Primary Indicator #1 pulled back today and so did Primary Indicator #2. This is an indication that the market could be starting a significant retreat. If Primary Indicator #1 moves back into the blue, it would signal a significant short-medium term (or longer) market decline.

Tuesday, June 10, 2014

Monday, June 9, 2014

Market Dashboard - Too Hot?

The indicators are all very hot. This could be telling us that a pullback is needed. I have my stops set pretty tight at this point.

Friday, June 6, 2014

Market Dashboard - Indicator Swing

Thursday, June 5, 2014

Market Dashboard - Undecided Market

An interesting turn of events today with a big new event from the ECB. Primary Indicator #2 reversed course, with the black needle leading the grey needle back toward the red zone. The Very Short Term indicator has spiked and the leading directional indicator has remained negative. If we have another strongly bullish day tomorrow I think the leading directional indicator might turn back to the bullish side. I learned several years ago that you should not fight the Fed when they make groundbreaking announcements; can the same be said for an ECB that actually punishes investors for buying bonds with a negative interest rate? Probably.

Wednesday, June 4, 2014

Market Dashboard - Leading Indicator turns Bearish

As I mentioned as a likely scenario in yesterday's analysis, the Leading Directional Indicator turned bearish today. Primary Indicator #2 is also showing bearish tendencies, with the black needle leading the grey needle away from the red zone. The market seems ready to show us another short to medium term top.

Tuesday, June 3, 2014

Market Dashboard - Neutral to slightly bearish

Primary indicator #2's black needle is leading the grey needle away from the red range. This is indicative of a potential top. Also, I think the Leading Directional Indicator could turn bearish tomorrow or the next day which would add validity to Primary Indicator #2.

Monday, June 2, 2014

Subscribe to:

Posts (Atom)