Sunday, November 9, 2014

Market Dashboard - Bullish wave showing signs of weakness

It has been quite some time since my last update! Things were looking pretty scary when the market decided to make a huge run to the upside. For the purposes of transparency, I did not expect that and I recommended that people be cautious with the upside trade. I completely missed out on the move, but that's just the way it goes sometimes. Currently, my RUM Wave indicators are showing that there is a little weakness happening in the market. It is not really that surprising, considering how far the market has moved!

Monday, October 20, 2014

Market Dashboard - little change

Not much has changed in market conditions. A mild upswing is probably underway as a "B" wave in this correction. I still consider the market risky for Bulls.

Saturday, October 18, 2014

Market Dashboard - Bounce, but not the end of downdraft

I think Friday's bounce was the start of an intermediate "B" wave, in Elliot Wave terms. That said, we could see some more upside out of it, but I don't think we are done with Primary Wave IV. Think 2011 for reference.

The SPY chart below looks like it is approaching a low point with regard to price volume, so I'm considering that as a potential point of resistance for bulls.

Monday, October 13, 2014

A quick selloff late this trading day continued to confirm EW theory that we are in Primary Wave 4. This means we are likely in a downtrend that will continue to last for a couple months. Intermediate rallies are a possibility, but they are risky and difficult to predict. The failure of the market to move into the overbought range of the RUM Wave indicators confirms the EW theory. Overall, bullish market bets are risky.

Tuesday, October 7, 2014

Market Dashboard - Neutral

Another brutal day for bulls in the market. EW suggests more downward movements to come. It is hard to say with conviction that a bullish rally is imminent given the recent declines. Any decisions to make a bullish bet on the market should be considered very high risk.

Monday, October 6, 2014

Market Dashboard - Bullish

RUM Wave indicators are still suggesting a bullish trend. Tomorrow's action will be a good tell for which way the market wants to move.

Sunday, October 5, 2014

Wednesday, October 1, 2014

Market Update-bearish

All signs point to a large corrective wave. Indicators are at very low levels, but the failure of the market to move higher and the Elliot Wave count are signaling continued bearish overtones.

Tuesday, September 30, 2014

Market update-stubborn wave

Apologies for poor posts the last 2 says, my day job had me on some abnormal hours so my schedule is off. Anyway, I do not feel fully confident in the market. The macro picture is leaving a lot of question marks in my mind. My signals are still bullish overall, but they have been in that range for too long without a rally. That leads me to believe a larger correction is unfolding.

Saturday, September 27, 2014

Market Dashboard - Critical Market Point

After a difficult week, RUM wave indicators reached an extremely bullish condition on Thursday. Friday gave us a strong bullish rebound, but investors should act with caution trading this market. Mandatory reading for my loyal followers is this excellent Elliot Wave weekly recap: click here.

The 4 hour charts for the major indexes (below) show some pretty strong short term bullish signals. Specifically, there are bullish divergences on all three charts and the IWM (small caps) is at a strong level of support. If we see the small caps break this level, it could result in a nasty decline in the overall market.

The 4 hour charts for the major indexes (below) show some pretty strong short term bullish signals. Specifically, there are bullish divergences on all three charts and the IWM (small caps) is at a strong level of support. If we see the small caps break this level, it could result in a nasty decline in the overall market.

Thursday, September 25, 2014

Market Dashboard - A Challenging Signal

Today the market hit the bulls hard as selling pressure violently accelerated. This appears to be a challenging moment for my indicators. I've been waiting for this scenario for a while. My basic philosophy is to monitor Elliot Wave for my long term market signals and to use RUM Wave to identify short to medium term entry points. Currently, my favorite EW-ers are calling a potential primary wave III top. To put it in more common terms, a primary wave III top will signal the start of a 2-3 month decline. Primary wave II took the market down over 20% before it was over; primary IV will likely be similar. The question everyone has is, are we there yet? My signals are just about as bullish as they get, so a failure to recover starting tomorrow would have me believe that primary III is complete. In fact, if we were somewhere else in the Elliot Wave pattern I would be calling this a screaming "buy" point. Protective orders on any remaining long positions are a worthy option.

Wednesday, September 24, 2014

Market Update - good bounce today

Sorry, no charts today! But, we had a good bounce and it should kick of a good bullish run.

Tuesday, September 23, 2014

Market Dashboard - finding a bottom

RUM Wave indicators took a hard swing back into the green over the last two days and now are very much on the low side of the range. One thing I have learned is that I have to trust the indicators and the criteria I have assigned them. Every time I have second guessed what the RUM wave was telling me, I was wrong. So, I maintain my bullish stance at this point. A bounce (at a minimum) is well overdue at this point. I look forward to seeing what tomorrow brings!

Saturday, September 20, 2014

Market Dashboard - bullish

Friday we observed a market pullback that was appropriately timed and expected. RUM wave suggests that there is still a lot of upside potential to this wave so any pullback is likely just a minor ease of buying pressure. I encourage readers to visit The Elliot Wave Lives On blog (click here.) You can find a detailed analysis of EW market conditions there. I find the information there to be quite complimentary to RUM wave indicators. The short story is that we should continue to see short-medium term upside movement, however there is likely a large correction on the horizon.

Below, the SPY looks to have pulled back to a level of support. I suspect we will see that be the bottom of this brief pullback.

Below, the small caps show a rocky road on with lots of ups and downs, but we have reached a level of support and the slow stochastic and RSI are at low levels. This also suggests that we should resume a push to the upside.

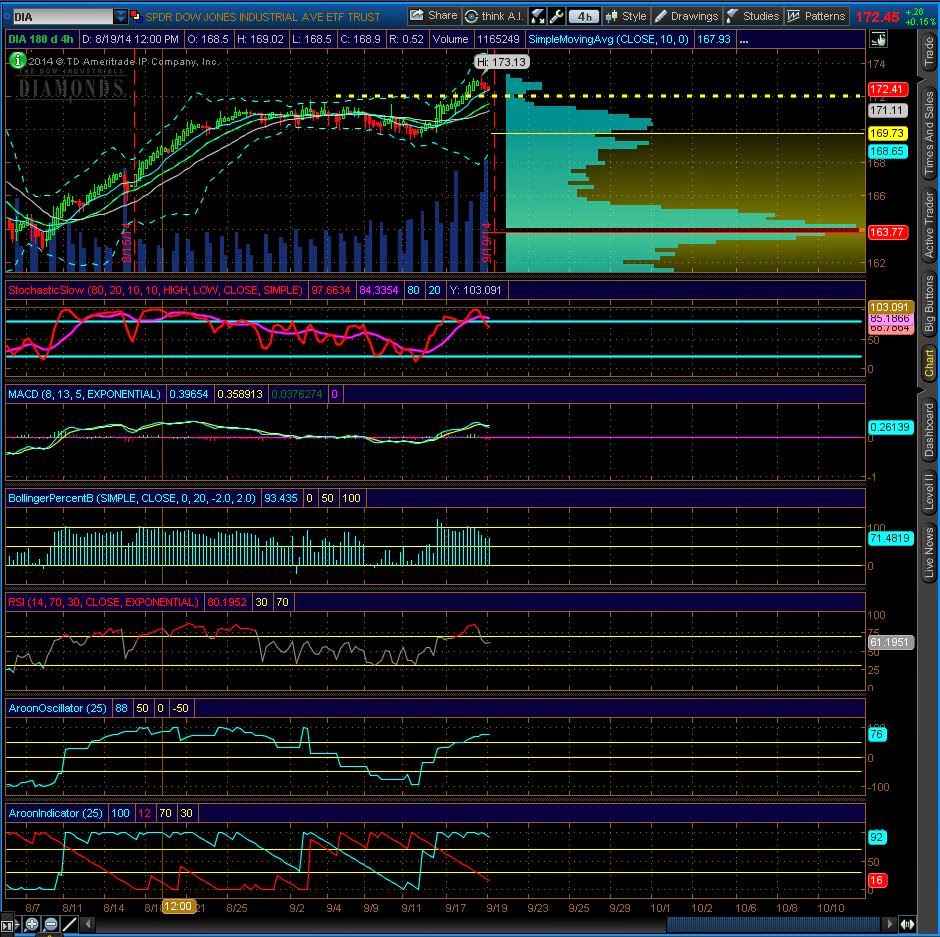

Finally, the DIA (below) looks very similar to the SPY with price reaching a mild level of support.

Thursday, September 18, 2014

Market Update - Solidly Bullish

RUM Wave indicators are now solidly bullish. The Leading Directional Indicator is now in the green bullish zone and Primary 1 and 2 have reversed course after reaching the green zones. I do suspect a quick pullback is in order after the last two days, but I view it as an opportunity to add to bullish positions.

Wednesday, September 17, 2014

Market Dashboard - Bullish Criteria Met

RUM wave indicators have satisfied my criteria to become officially bullish. Primary Indicator 1 is in the green, Primary Indicator 2 is crossing in the green, the Very Short Term indicator was in the green a couple days ago and is still on the bullish side of the arc. Tomorrow we will hear about Scotland's vote and trade around "trader's digestion of FED data." For me, I plan on taking this opportunity to go long in tripple levereged ETFs. For more seasoned investors, it is an opportunity to consider bullish option strategies.

Tuesday, September 16, 2014

Market Dashboard - bulls not yet confirmed

While today's bullish jump was nice to see, it did not inspire a bullish signal (yet) in my RUM Wave indicators. I'm waiting for the needles of Primary Indicator #2 to cross and for the LDI to swing into the green. It could very easily happen tomorrow.

Monday, September 15, 2014

RUM Wave indicators are getting quite close to a reversal point. Primary 1 is in the green zone and the leading needle of primary 2 is just crossing into the green. The Very Short Term indicator is solidly in the green. I'd like to see the Leading Directional Indicator turn bullish with both needles of Primary 2 in the green zone. That would be a potential recipe for bullish success. I think it may happen in the next couple days.

Friday, September 12, 2014

Market Dashboard - Indicators marching lower

My market indicators continue to march toward the "green zone" which is a good thing for those that are on the sidelines waiting for the next bullish signal. I have drawn in a blue line on the IWM chart (below) indicating a possible inverted head and shoulders formation forming. Those are bullish in nature and would suggest a bullish move in the small caps if it continues to form next week.

Wednesday, September 10, 2014

Tuesday, September 9, 2014

Today's small selloff drove RUM wave indicators lower. Primary Indicator #2 retreated and the Very Short Term Indicator reached the green zone. Neither one indicates that the consolidation / correction is complete, however it is getting closer to a bounce point. In the SPY and IWM charts below I have highlighted Fib retracement levels that could provide support if we continue to see lower moves. I was personally stopped out of all my equity market positions as a result of my trailing stop.

Monday, September 8, 2014

Saturday, September 6, 2014

Market Dashboard - Choppy Bullish Future

RUM Wave indicators continue to move to lower levels, particularly Primary Indicator #2. This decline is interesting because we are not seeing much movement in the SPY. This leads me to believe the SPY is in a sideways consolidation mode, and I think we would have seen the drop if it was going to happen. Additionally, the ECB announced a round of economic stimulus just as the US FED is preparing to end theirs. This provides some more bullish motivation for US and European equities. Investors should continue to protect themselves from downside moves. Trailing stops are a useful tool to ride the wave higher and while simultaneously positioning yourself to secure profit if you are happy with your returns.

Thursday, September 4, 2014

Today's ECB rate move had a very positive effect on the market at the start of the trading session, but weakness / bearishness prevailed throughout the rest of the day. My dashboard indicators are accelerating to the downside (shown with the red arrow on Primary Indicator #2.) Additionally, small caps had the first candle below their recent uptrend trendline on my chart (circled in blue below.) The S&P still looks okay, and we probably had enough of a decline today to see a higher day tomorrow, but my indicators are still causing me to analyze the market as one that should be treated with caution.

Wednesday, September 3, 2014

Market Dashboard - neutralish

Market activity continues to be mostly neutral. Protective stops are still warranted for investors seeking protection from event-driven market swings.

Tuesday, September 2, 2014

Market Dashboard - Not much has changed

There's not a lot of change to speak of today. Small caps are chugging right along their trendline and large caps are marching sideways. I'll still keep my stops set at reasonable levels just in case things go haywire.

Sunday, August 31, 2014

Market Dashboard - sideways consolidation

Market conditions continue to lend favorability to the Bulls. The sideways movement of the SPY is giving most oscillators time to reset without a significant reduction in overall price. Even though my short term outlook is bullish, as well as medium term, I encourage readers to visit the blog "The Elliot Wave Lives On." Click here. This is a daily read for me and this weekend's update is particularly interesting. The bottom line is that they think we are close to a longer term top and are projecting it may materialize within the next month or so. As such, it is probably wise to begin formulating a gameplan for a bearish medium term market.

Thursday, August 28, 2014

Market Dashboard - Cooling signals

Today's pullback was long needed, so I was relieved to see it. I was also pleased to see the market rally off the lows of the day to end only marginally down. What interests me on the SPY chart below is that we are seeing an increase in volume at current price levels. I think the 2000 level on the S&P 500 is an important psychological level. If we can get above it again I think another leg of the rally could take hold. However, this is a potential inflection point so investors should be positioned to protect themselves in the event of continued declines.

Tuesday, August 26, 2014

Market Dashboard - little change

Another move higher for the day on the markets. Interestingly, the SPY only moved up .06% while the small caps climbed .9%. Really, not much change to speak of. If I were to draw an analogy of the market to a spring, it would be a spring that has become fully extended, and maybe a bit beyond that. For that reason, investors would be wise to position themselves so that profits could be taken if individual investing targets are met. One technique would be to add a trailing stop to index ETFs so that profits could continue to grow and downside protection is maintained.

More info on Elliot Wave Theory.. Elvis, click here.

More info on Elliot Wave Theory.. Elvis, click here.

Monday, August 25, 2014

Market Dashboard - Hot Indicators..again

Today brought another high for the market and returned my indicators into the red zones. I'm still hoping for a higher high, but we really need a little break here. Below I've outlined a couple levels of support if the market does start to pull back some.

Subscribe to:

Posts (Atom)