Well, ladies and gents, I've given a lot of thought to this blog the last few days and the time-cost of it. After about 10 months of daily updates (give or take a day or two here and there,) I've decided that I want to reallocate my time each night to other things. Accordingly I will only update this blog on the weekends when I have more time available. Thanks to the regular readers out there across the planet, and I hope you continue to find this information useful in your market analysis. I'll post updates if things are news worthy. I'll also update my thoughts on Twitter, so feel free to follow me @RumWave.

Here's were we stand:

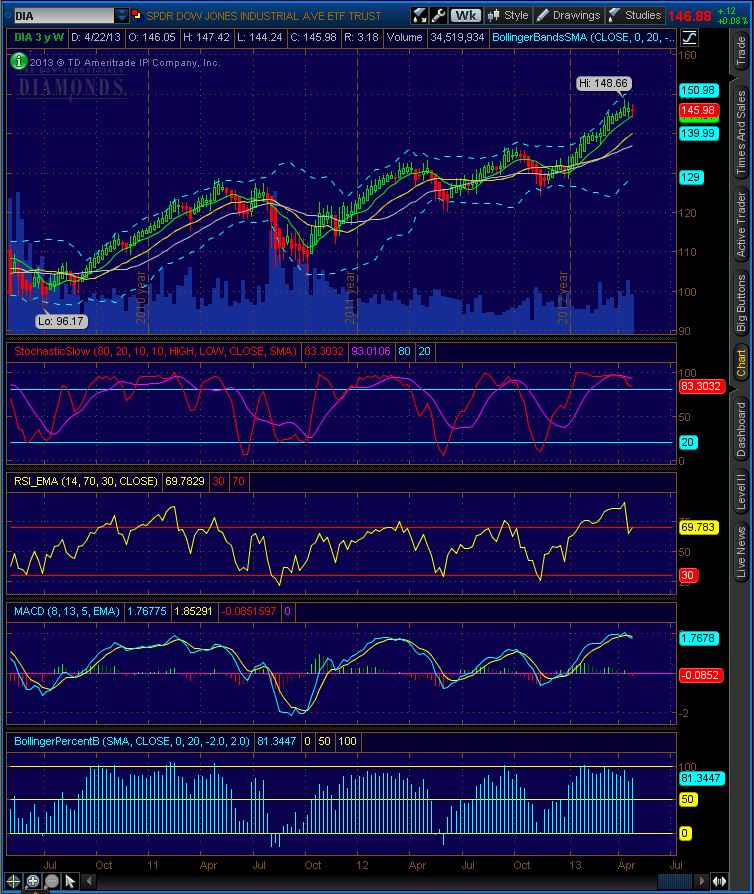

- Weekly charts are giving way to some weakness. Witness the red candle at the top of the DIA weekly chart:

Here are the daily scores. They suggest that on a short term level, there is some room to move higher still:

Overall, I'm very cautious of the market's intentions. I think we may end up seeing some volitility as the market find its top here. This should benefit traders that use shorter scale charts (4hrs and less).

My position is that of "Hold" and/or secure profits.

GOOD LUCK NEXT WEEK, I'll see you next weekend!