Thursday, July 31, 2014

Market Update - No Man's Land

For the first time in a long time, RUM Wave indicators are in No-Man's Land. Primary 1 and 2 have reversed after failing to produce positive returns. This puts all of my indicators in a never-never land of indecision. For now, I will have to wait to see what the market decides to do. After such a big selloff today, tomorrow is likely to see some kind of bounce. Nervous investors should consider using that as an opportunity to move to the sidelines until a more clear signal develops.

Wednesday, July 30, 2014

Market Dashboard - positive

RUM Wave indicators are still positive. The small caps are carrying the weight of the market right now while the large caps are having difficulties. I expect this trend to continue for the near future.

Tuesday, July 29, 2014

Market Dashboard still positive

There is no doubt that this wave has been the most difficult I've seen in recent past. However, indicators are still bullish. It will be difficult to predict geopolitical turns and twists as we go.

Saturday, July 26, 2014

Market Dashboard - trend still points higher

Even though there was a nasty little selloff Friday, the indicators are still bullish. The small caps have a little natural support at current price levels thanks to Fibonacci levels. The chart below shows the wave that occurred last week. The IWM should find some footing around the $113.25 - $113.68 range. Failure to hold that, however, may indicate continued selling.

The S&P 500 may not be completely done declining, but the 50% retracement coincides with a price volume node so we may see some support at the $197.34 price level.

Thursday, July 24, 2014

Market Dashboard - cause for protective stops

Today's post is specifically directed toward those that trade with me. I am seeing some weakness in the LDI. Although the indicator is still bullish, it is showing some signs of slowing momentum in the overall market. That said, I STRONGLY recommend protective stops.

TNA Protective Stop that I'm using is $69. (Below)

UDOW protective stop I am using is $122.

Tuesday, July 22, 2014

Market Dashboard - Uptrend

The RUM Wave dashboard continues to show the market in the uptrend that started last week. I expect this to continue for the next 1-3 weeks, depending on how violent the upswing is.

Monday, July 21, 2014

Market Dashboard - Bullish

The market dashboard is still favoring a bullish move in the near future. I think we will likely see it materialize over the next couple trading sessions. The IWM has likely formed a bottom and was giving back a little ground today after a big run on Friday.

Saturday, July 19, 2014

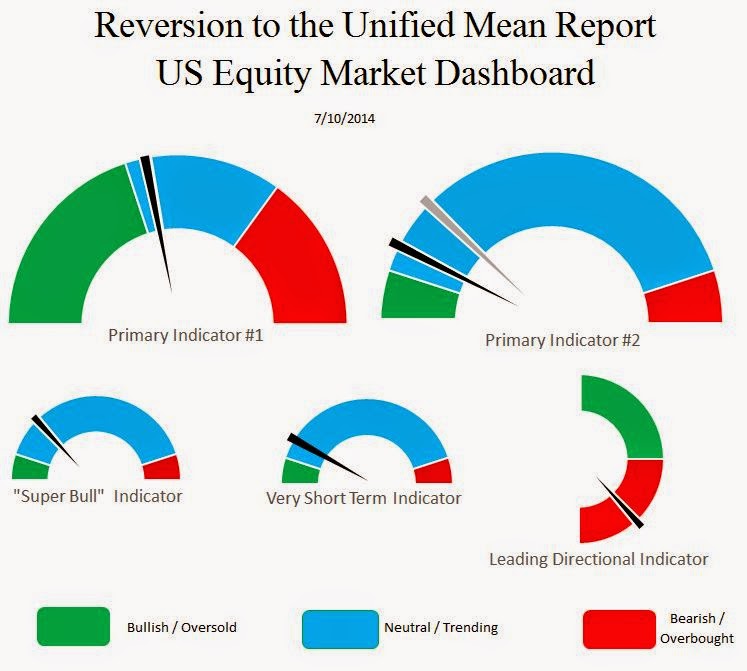

Market Dashboard - Indicators Turned Positive

RUM Wave indicators have signaled a bullish wave entry point. Earlier in the week the Super Bull indicator was triggered, however it was a little premature. Now we are seeing a reversal of Primary Indicator 2 after it touched the green zone. Primary indicator one is in the green zone. On Friday morning, the Very Short Term Indicator was also in the green. Finally, the Leading Directional Indicator has turned positive. All of these events suggest a bullish impulse began on Friday and will continue for the short to medium term.

Below, the IWM chart is quite busy but price action has rebounded off the 61.8% Fibonacci retracement line, and at a node of increased price volume (indicated by the turquoise graph.) This chart looks like the most likely candidate for a substantial rally.

The SPY chart below shows some sideways consolidation. Traditional analysis would suggest that it looks ready for a correction. However, RUM Wave analysis suggests that it is about to start a small bullish impulse.

Friday, July 18, 2014

Wednesday, July 16, 2014

Market Dashboard - Entry Point

Today Primary Indicator #1 moved solidly into the green arc. With the Super Bull indicator also firmly in the green, I'm comfortable calling this a good entry point. I think we could easily see a breakout move in the next session or two. I look forward to seeing the LDI in the green, but that is probably at least a day out.

Tuesday, July 15, 2014

Market Dashboard - Super Bull indicator in the green

Today the Super Bull indicator made a very strong swing to the bullish side. In fact, it is literally the best it can get. That said, we could see another day or so of the big indexes finding their bottoms, but this is a good time to start scaling into positions. Right now the small cap index chart looks more promising than the megacaps from a standpoint of which index is likely to bounce first.

Monday, July 14, 2014

Market Dashboard - early reversal

Today's reversal was somewhat expected, however it was a little premature to call a RUM Wave entry point. It may have been the bottom, but I'm not yet convinced the bears have given up.

Saturday, July 12, 2014

Market Dashboard - Holding fast

RUM wave dashboard indicators are beginning to enter the green zone, specifically Primary Indicator #1. For a solid entry signal we need the following to happen: 1) Primary #1 in the green zone 2) Primary #2 in the green zone with a reversal of needles (black above the grey.) The caveat to both of those would be if the Leading Directional Indicator turns positive in the coming week. Ideally, we'd like to see all three happen at about the same time. I'm also watching the Super Bull indicator, which has the potential to reach the green zone next week.

In the charts below we can see that the small caps are in a pretty solid downtrend while the SPY is at a price level with lots of previous trading volume (indicated by the blue graph on the right.) I would consider it a potential pivot point - either higher or lower. I think we may see a little bounce early in the week, hopefully followed by another larger downleg to create an oversold condition that will signal a solid entry point.

In the charts below we can see that the small caps are in a pretty solid downtrend while the SPY is at a price level with lots of previous trading volume (indicated by the blue graph on the right.) I would consider it a potential pivot point - either higher or lower. I think we may see a little bounce early in the week, hopefully followed by another larger downleg to create an oversold condition that will signal a solid entry point.

Thursday, July 10, 2014

Market Dashboard - Not entry yet

Even though today was a significant move lower, I do not see this as an entry point. There is still more downside needed before the RUM Wave indicators move into buying territory. Today we again saw the SPY cut some losses, but the IWM (Russell 2000) was down by a little more than 1%. The timeline for market entry looks to be targeting sometime next week.

Wednesday, July 9, 2014

Market Dashboard - Closer to entry point

The needles on the dashboard are all moving toward the green areas, but they are not yet signaling a solid entry point. Interestingly, in the charts below you will see that the SPY showed a little strength, but the IWM (small caps) showed continued weakness. The math behind RUM Wave heavily considers small cap movements, usually as foreshadowing events to the larger cap indexes.

Tuesday, July 8, 2014

Market Dashboard - Still not an entry point

The SPY and IWM oscillators (below) suggest that a short bounce is in order, but RUM Wave analysis does not suggest that this is a good entry point for a medium term investment.

Sunday, July 6, 2014

Wednesday, July 2, 2014

Tuesday, July 1, 2014

Market Dashboard - Unexpected Spike

Today's market spike was not expected. The LDI is still bearish (barely.) My analysis does not suggest that this is a good entry point.

Subscribe to:

Posts (Atom)