Due for a pause in the action

Yesterday I wrote that I expected a pullback today. That did not happen and the market decided to push a bit higher. While that may seem like a good thing, it just pushed us further into overbought territory. The RumWave is still suggesting there is more upside, but I think we will see a little snap back before moving to new highs.

The daily scores above show some solid pushes into orange-red territory. The internal components that make up the 4 hr and Daily scores also displayed several "red" numbers.

On the 4 hr chart above I have highlighted a bearish divergence between the higher highs on the candlesticks and the lower highs on the RSI (yellow lines). This is a signal that a pullback is probably just around the corner.

The slow stochastic on the daily chart above is at 91.8. This is a high number. It usually doesn't go much higher before turning down.

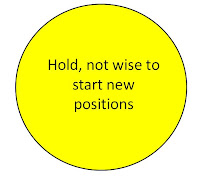

Overall, I am still holding my long positions. I expect a pullback, but the RumWave is not producing a sell signal so I will wait until then to take profits.

GOOD LUCK TOMORROW!

No comments:

Post a Comment