Friday we observed a market pullback that was appropriately timed and expected. RUM wave suggests that there is still a lot of upside potential to this wave so any pullback is likely just a minor ease of buying pressure. I encourage readers to visit The Elliot Wave Lives On blog (click here.) You can find a detailed analysis of EW market conditions there. I find the information there to be quite complimentary to RUM wave indicators. The short story is that we should continue to see short-medium term upside movement, however there is likely a large correction on the horizon.

Below, the SPY looks to have pulled back to a level of support. I suspect we will see that be the bottom of this brief pullback.

Below, the small caps show a rocky road on with lots of ups and downs, but we have reached a level of support and the slow stochastic and RSI are at low levels. This also suggests that we should resume a push to the upside.

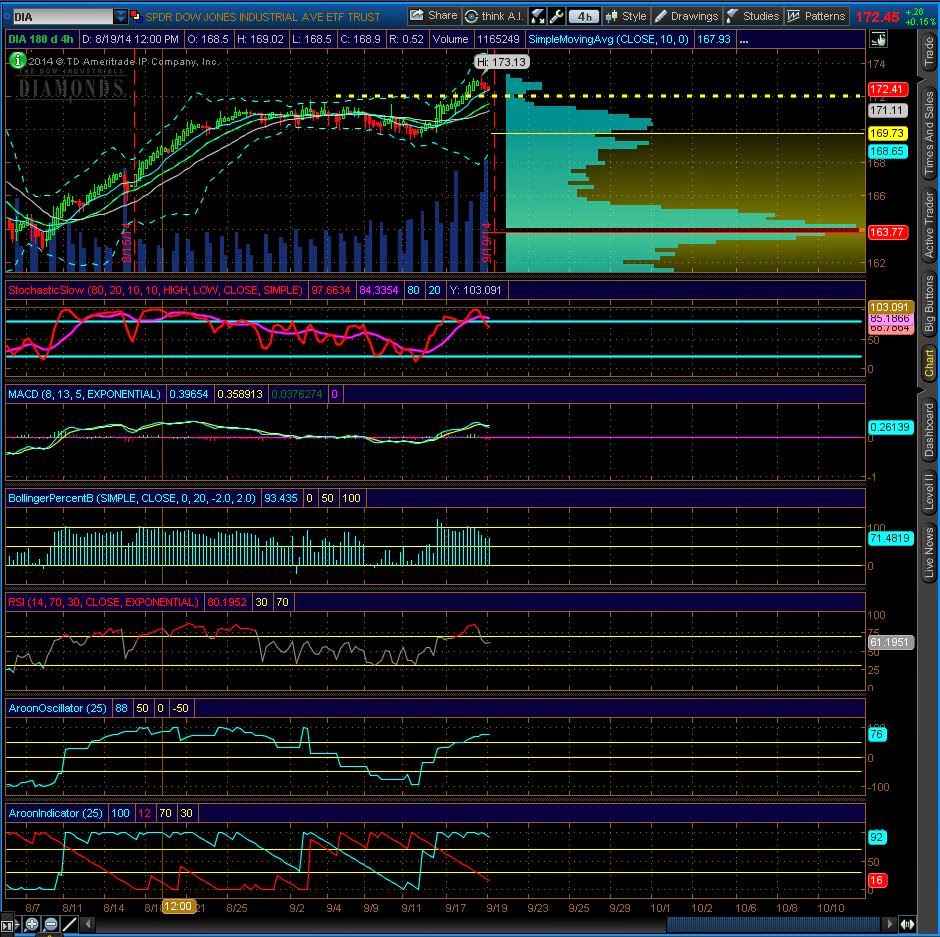

Finally, the DIA (below) looks very similar to the SPY with price reaching a mild level of support.

No comments:

Post a Comment