Friday was a pretty calm day until the last hour or so of trading. It was at that point that the SPX challenged its resistance level that I discussed on Thursday's post. The headline on CNBC after the close was something to the effect of "S&P reaches all time high" but on closer inspection I don't think it was a successful move above resistance. The funny thing about traditional technical analysis is that it is all technique and often depends on how thick your pencil led is. By that, I mean that resistance and support levels are really more of a tight range than a specific point on a chart. I don't consider Friday to be a successful move above resistance because the last few candlesticks on the 5 minute chart showed that bears successfully smacked the price down into the resistance range in the last few minutes of trading.

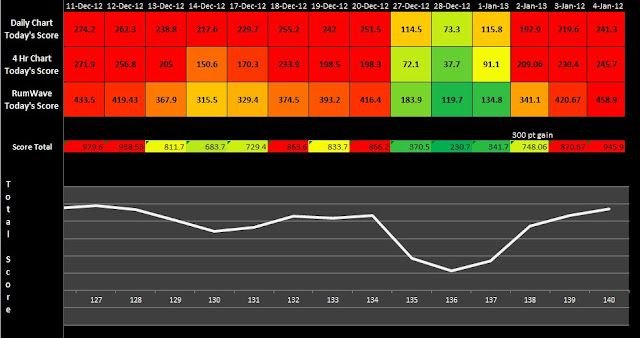

Daily scores:

30,000 ft view of the scores since I started tracking them:

The DJIA daily chart below shows some pretty high oscillator values in the lower graphs:

The DJIA 4 hr chart below is zoomed in to the "fiscal cliff rally." I've highlighted (in yellow) the "twisted ribbon" appearance of the Heikin Ashi candles that I sometimes talk about. I like it because it shows that the upward momentum is drying up. On moves like this we often see some red candles pretty quickly, which would indicate a change in trend. A green candle outside of the top yellow line would usually indicate that the next impulse will be to the up side.

The bottom line is that I am setting up a trade trigger to buy a DIA Put option on Monday IF we move lower. THIS IS A GAMBLE, not a RumWave sell signal. There may be another attempt by the market to move higher, but I find it to be the path of more resistance.

TSP: G fund

401k / IRA : Low risk assets

Questions or comments? Email me: rrumwavetrading@gmail.com

GOOD LUCK NEXT WEEK!

No comments:

Post a Comment